Imagine a world where you can manage all your banking needs without ever stepping into a bank branch. Need to deposit a check? Snap a picture with your phone. Want to transfer money? Tap a button. This is not a far-off dream but the reality of modern banking. As technology advances, the concept of banking is rapidly evolving, moving beyond the traditional brick-and-mortar branches to a more digital and accessible form. Welcome to the future of banking beyond branches.

Rise of Digital Banking

Digital banking refers to the use of digital platforms and technology to carry out banking activities. This includes online banking, mobile banking apps, and various fintech services. The shift towards digital banking has been driven by the need for convenience, speed, and efficiency.

Impact of Mobile Banking

Mobile banking apps have revolutionized the way we interact with our finances. According to a report by Statista, in 2020, there were over 1.9 billion mobile banking users worldwide, a number that is expected to grow to 2.5 billion by 2024. These apps allow users to perform a wide range of transactions, from checking account balances to making payments and transferring funds.

Chime a mobile-only bank in the #United States, has gained popularity for its user-friendly app and fee-free services. With features like early direct deposit and automatic savings, Chime has attracted millions of customers who prefer managing their finances on their phones.

Convenience of Online Banking

Online banking has made it possible to access banking services from the comfort of our homes. Whether it’s paying bills, applying for loans, or setting up automatic payments, online banking platforms offer a seamless experience. A survey by the American Bankers Association found that 73% of Americans used online banking in 2021, highlighting its widespread adoption. According to the Federal Reserve, 82% of U.S. adults used online banking services in 2022, showcasing the growing trend towards digital financial management.

Banking beyond branches offers numerous advantages that cater to the needs of modern consumers. These benefits include convenience, accessibility, cost savings, and enhanced security.

Convenience and Accessibility

With digital banking, you can perform banking transactions anytime, anywhere. This 24/7 access eliminates the need to visit a physical branch, making banking more convenient for people with busy schedules.

A report by Deloitte found that 90% of banking interactions are now conducted through mobile devices, indicating a significant shift towards mobile banking.

Cost Savings

Digital banking reduces the need for physical infrastructure, leading to cost savings for banks. These savings can be passed on to customers in the form of lower fees and better interest rates.

A study by McKinsey & Company revealed that digital banking can reduce operational costs by up to 30%, allowing banks to offer more competitive products and services.

Digital banking platforms use advanced security measures, such as encryption and biometric authentication, to protect user data. This ensures that your financial information is safe from cyber threats.

Role of Fintech in Banking Transformation

Fintech plays a crucial role in the transformation of banking beyond branches. Fintech companies leverage technology to offer innovative financial services that challenge traditional banking models.

Peer-to-Peer (P2P) Lending

P2P lending platforms connect borrowers directly with lenders, bypassing traditional banks. This not only provides borrowers with access to loans at competitive rates but also offers lenders attractive returns on their investments.

Example: LendingClub

LendingClub, a leading P2P lending platform, has facilitated over $60 billion in loans since its inception. By connecting borrowers and investors, LendingClub has created a more efficient lending process.

Digital Wallets and Payment Apps

Digital wallets, such as Apple Pay, Google Wallet, and PayPal, allow users to make payments, transfer money, and store digital currencies securely. These apps offer a convenient and secure way to manage financial transactions.

According to eMarketer, the number of digital wallet users in the United States is expected to reach 101.2 million by 2023, reflecting the growing popularity of these payment solutions.

Robo-Advisors

Robo-advisors use algorithms to provide automated investment advice based on users’ financial goals and risk tolerance. These platforms make investing more accessible and affordable for a broader audience.

Betterment a prominent robo-advisor, manages over $22 billion in assets for more than 600,000 clients. By offering personalized investment advice at a lower cost, Betterment has democratized investing.

While digital banking offers many benefits, it also presents certain challenges that need to be addressed.

Digital Divide

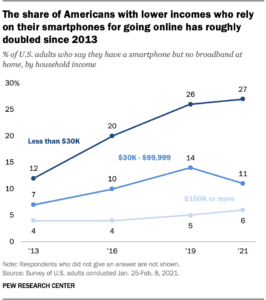

Not everyone has access to the internet or digital devices, which can create a digital divide. This gap can prevent some individuals, particularly those in rural or low-income areas, from accessing digital banking services.

According to the Pew Research Center, 7% of Americans do not use the internet, with higher rates of non-usage among older adults, rural residents, and those with lower incomes.

Image: Digital divide and income erosion

Cybersecurity Threats

As digital banking becomes more prevalent, the risk of cybersecurity threats also increases. Banks must invest in robust security measures to protect against hacking, phishing, and other cybercrimes.

A report by Accenture Accenture found that the financial services industry experienced a 48% increase in cyberattacks in 2020, highlighting the need for enhanced security measures.

Regulatory Compliance

Navigating the regulatory landscape can be challenging for digital banks and fintech companies. They must comply with various regulations and standards to ensure the safety and security of their services.

The General Data Protection Regulation (GDPR) in the European Union imposes strict data protection requirements on businesses, including digital banks, to safeguard customer information.

The Future of Banking Beyond Branches

The future of banking is undoubtedly digital, with continued advancements in technology set to further transform the industry. Here are some trends and innovations to watch out for.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning are poised to revolutionize banking by providing personalized financial services, enhancing fraud detection, and improving customer service through chatbots and virtual assistants.

Bank of America virtual assistant, Erica, uses AI to help customers manage their finances, answer questions, and perform transactions. Erica has handled over 100 million customer requests since its launch.

Blockchain Technology

Blockchain technology has the potential to enhance the security and efficiency of financial transactions. By providing a transparent and immutable ledger, blockchain can reduce fraud and streamline processes.

Ripple a blockchain-based payment protocol, enables fast and secure cross-border transactions. Major financial institutions, including Santander and American Express, have partnered with Ripple to improve their international payment systems.

Open banking allows third-party developers to build applications and services around financial institutions. This promotes innovation and competition, leading to better products and services for consumers.

According to Allied Market Research, the global open banking market is expected to reach $43.15 billion by 2026, driven by the increasing demand for innovative financial services.

Biometric Authentication

Biometric authentication, such as fingerprint and facial recognition, is becoming more common in digital banking. This technology offers a secure and convenient way to verify identities and protect accounts.

HSBC has introduced facial recognition technology for its mobile banking app, allowing customers to securely access their accounts using their smartphones.

Banking beyond branches represents the future of financial services, offering unparalleled convenience, accessibility, and efficiency. As technology continues to advance, digital banking will become even more integrated into our daily lives, transforming the way we manage our finances. While challenges such as the digital divide and cybersecurity threats must be addressed, the potential benefits of digital banking are immense. By embracing innovation and leveraging cutting-edge technologies, banks and fintech companies can create a more inclusive and secure financial ecosystem for all.

By staying ahead of the curve and continually evolving, the financial industry can ensure that banking beyond branches becomes the norm, providing customers with a seamless and efficient banking experience.